Happy Tuesday! Today we’re breaking down the numbers on a 4-unit property for sale in Las Vegas. Going forward, we’ll continue sharing house hacks, but we’ll also throw in some variety and analyze deals for other types of real estate (e.g. Airbnb, self storage, land). Anyways, let’s get into it.

Here’s the fourplex we’re looking at - it’s currently listed for $850k and has the following unit breakdown:

Three 2 bed/2 bath units

One 3 bed/2 bath unit (currently being renovated)

This fourplex is in Winchester, a neighborhood located on the east side of Las Vegas close to the strip. We’ll assume that we purchase the property for $850k and put in $50k to finish renovations on the 3-bedroom unit. The other units are all pretty high-quality and were recently renovated.

We’re going to make the following assumptions:

20% down with a 30-year fixed mortgage at 7.5% interest rate

0.65% annual property tax rate (based on Las Vegas’ current rates)

$200/mo home insurance

10% reserve for capex and maintenance

5% vacancy rate

2% annual rent and expense increase

With interest rates where they’re at right now, we’ll have to make some sacrifices to make the numbers work. We’ll live in the 3-bedroom unit and rent out the remaining 2-bedroom units and the two spare bedrooms in our unit.

Looking at rental comps in the area, it looks like we’ll be able to rent the 2-bedroom units for about $1,500. Based on rooms for rent on Craigslist in the area, we can rent out each of the spare rooms in our unit for $750/mo. That brings our total monthly rental income to $6,000.

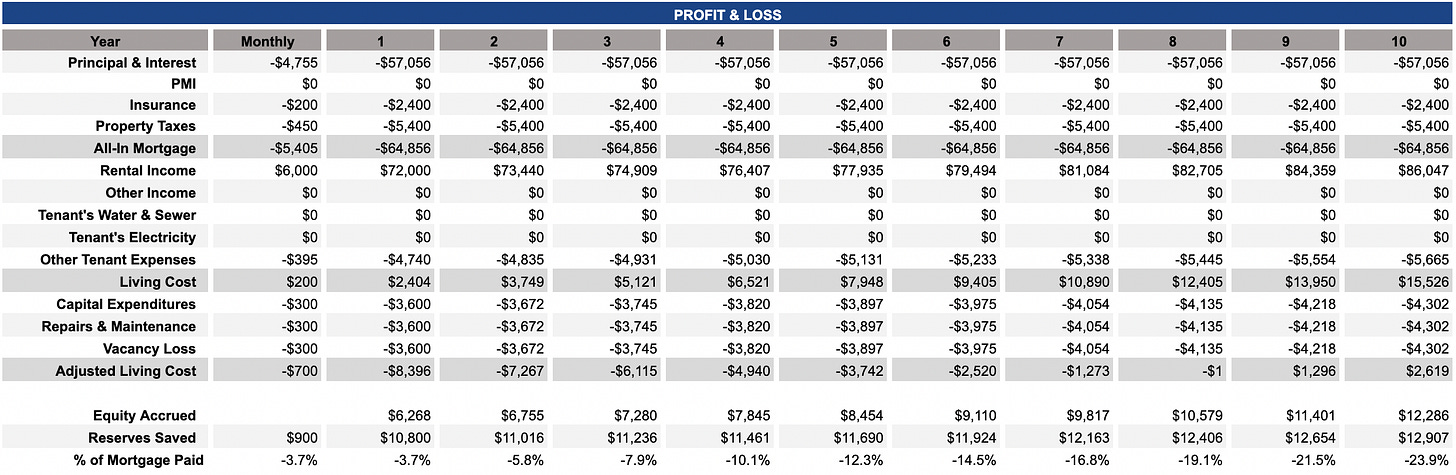

Plugging these numbers into our house hacking calculator (reply to this email and I’ll send you the link!), we get the results below.

Our monthly expense for mortgage + insurance + property tax is $5,405 and we’re bringing in $6,000 in monthly rental income. After accounting for the $395/mo HOA fee, we’re making $200/mo in the first year - not bad!

In the first year, we’re putting aside $10,800 ($900/mo) for capex, maintenance, and vacancy. Rolling that into our calculations, our year 1 out-of-pocket living cost comes out to $8,396. We also accrue $6,268 in home equity in our first year, so the net cost comes to $2,128 or $177/mo. Based on the current financials, we’ll start breaking even on our out-of-pocket costs (not including equity buildup) in year 8.

The numbers on this deal are solid - you’re not printing cash but you’re living for much cheaper than you’d be able to rent for. The downside with this property is having to finish the rehab on the 3-bedroom unit. That means at least a few months of the unit being off the rental market. On top of that, the cash outlay increases pretty substantially from $170k (20% down) to $220k. According to the listing, the seller is willing to complete the renovation before the close of escrow, so that might be something to look into. If you do that, the property won’t have to be off-market while you’re renovating it yourself, and you can roll the renovation costs into the mortgage through a higher purchase price. In that case, we’d have to run the numbers again since the monthly mortgage payment would be higher.

Would I buy this property? Probably not. Living for (almost) free is great but after taking into account the initial cash outlay of $220k, the return in both cash and equity isn’t promising enough to justify pulling the trigger. One long-term possibility is buying now and refinancing in the future when interest rates drop. That would make this deal much more viable but if the numbers pencilling out is wholly dependent on rates dropping, it’s probably not a good deal.

I appreciate you reading until the end - see you next week!