Warren Buffett's rule #1 for investing is to NEVER lose money. Rule #2 is to never forget rule #1.

Why is that?

It's because of the way the math works when having to "get back to even" when you've experienced losses.

This is one of the most misunderstood pieces of investing, and it haunts investors that aren’t aware of it, without them even knowing.

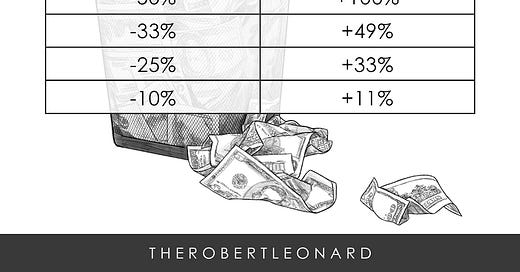

If you lost 50% of your $100 investment, you'd be down to a remaining amount of $50. In order to get that $50 back to $100, you'd need to double your money, or earn a 100% return.

Crazy, right? 50% loss requires a 100% return JUST TO GET BACK TO EVEN.

I realize this doesn't seem like a huge deal when we're talking about $50 and $100, but what if this was $100,000, or even $10,000?

If you had $100,000 and lost 50%, you'd be down to $50,000, and would again need to DOUBLE your money just to get back to even. Doubling $50, not so hard. Doubling $50,000, or even $5,000, MUCH harder.

Even at a 33% loss, you still need to earn a 49% return just to get back to even.

25% loss requires a 33% gain, and a 10% loss requires an 11% gain, just to get back to $0 gain.

Remember, stocks generally go up and to the right over the long-term, BUT, they typically go down much faster than they go up.

I like to take quite a bit of risk with my investments, I'm young, I can weather the storm, but that doesn't change the mathematical relationship we just discussed - a 50% loss will always require a 100% gain JUST TO GET BACK TO EVEN.

All the best,

Sponsored By

Norwood Energy drills and operates, profitably, oil & gas wells with a 90% success rate. A disciplined and economically-efficient approach provides investors the opportunity to benefit from a lower price point than most industry-level deals.

Hear more about Norwood Energy’s business here, or contact them directly at (817) 600-4246.