Happy Tuesday! Today, we're venturing into the Pacific Northwest to explore the investment potential of a duplex in Portland. Let's dive into the numbers and see if this property is a house hacking gem!

Here’s the duplex we’re looking at - it’s currently listed for $995k and consists of a 2bd/1ba unit on the first floor (currently occupied) and a vacant 4bd/2ba unit on the second floor.

The home, built in 1911, is nestled in the heart of Buckman, a neighborhood known for its historic homes, bustling cafes, and proximity to downtown Portland. Given its age, the property carries the charm and character typical of early 20th-century architecture. We'll assume that we purchase the property for its asking price of $995k. While the home's age might raise concerns about potential repairs, we won’t allocate any money for immediate renovations. However, given its vintage, we'll definitely set aside a budget for capex and repairs.

We’re going to make the following assumptions:

20% down with a 30-year fixed mortgage at 7.5% interest rate

0.94% annual property tax rate (based on Portland’s current rates)

$350/mo home insurance

10% reserve for capex and repairs

5% vacancy rate

2% annual rent and expense increase

Since this is a duplex, we'll live in the 4bd/2ba unit and rent out three of the bedrooms for added income.

The 2bd/1ba unit is already occupied, and based on local comps, it's estimated to bring in around $2,000/mo. We’ll assume that’s the current rent, although it’s very likely that it’s lower if the current tenants have occupied the unit for a while. For the bedrooms in our 4bd/2ba unit, local listings suggest we can command around $1,000/mo per room, given the property’s location. Combining the estimated rent from the occupied unit and the potential income from the three bedrooms in our unit, our total monthly rental income will be $5,000.

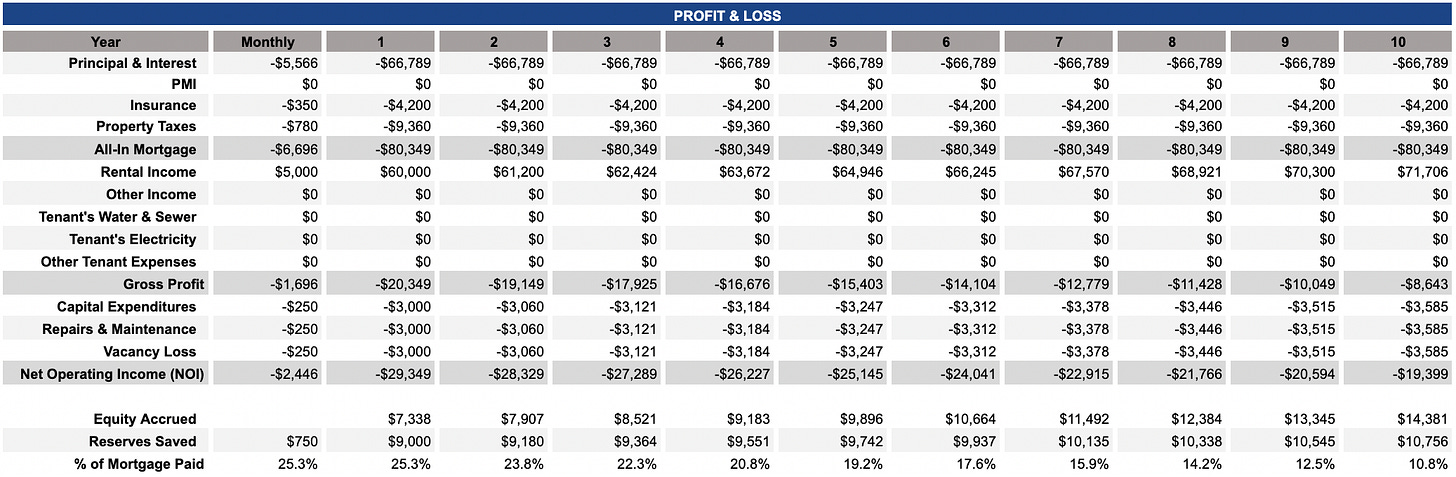

Plugging these numbers into our house hacking calculator (reply to this email and I’ll send you the link!), we get the results below.

Our monthly outlay for mortgage + insurance + property tax comes out to $6,696. With our rental income of $5,000, we’re looking at a deficit of $1,696/mo in our first year living in the property ($20,352 for the whole year).

We’re also setting aside $9,000 ($750/mo) in the first year for capex, maintenance, and vacancy. Given the property's age, this is a crucial consideration. Including that, our year 1 out-of-pocket living cost is $29,352. We accrue $7,338 in home equity in our first year, so the net living cost comes to $22,014 or $1,835/mo.

Shelling out $1,835/mo to live in a shared unit of a duplex, especially after a 20% down payment, is pretty considerable.

One strategy to increase our rental income would be to furnish the extra bedrooms in our unit and market them to young professionals or students. Given Buckman's appeal, we could expect to make an extra $150-250/mo per bedroom. This would help reduce the monthly deficit, but there would still be a gap.

Another option would be to consider short/medium-term rentals. Renting rooms to travel nurses or on platforms like Airbnb might yield higher monthly rates compared to long-term leases. However, this comes with the added overhead of frequent tenant turnover and management.

Would I purchase this property? With the current numbers, I’m hesitant. The current monthly deficit is a significant concern that can't be overlooked. The accrued equity does provide some relief, but the age of the property and the associated capex considerations add an additional layer of complexity. Portland's rental market is robust, but as a potential buyer we have to seriously consider whether we actually come out ahead buying versus renting.

Thanks for reading! Catch you in the next edition!