Happy Thursday! Today we’re crunching the numbers on a single-family home for sale in Charlotte, North Carolina. Let’s see if the numbers pencil out!

Here’s the duplex we’re looking at - it’s currently listed for $799.5k and has two 3 bed/1 bath units.

This duplex is in the Wesley Heights neighborhood of Charlotte, a neighborhood known for its historic charm and proximity to the city center. We’ll assume that we purchase the property for the asking price. The interior is in great condition, so there’s no immediate need for repairs and renovations.

We’re going to make the following assumptions:

20% down with a 30-year fixed mortgage at 7% interest rate

0.78% annual property tax rate (based on Charlotte’s current rates)

$280/mo home insurance

10% reserve for capex and maintenance

5% vacancy rate

2% annual rent and expense increase

Since this is a duplex, we’re going to live in one unit and rent out the other. We’ll also see how the numbers pencil out when we rent out the remaining two bedrooms in the unit we’re living in. Wesley Heights is a pretty desirable neighborhood in Charlotte, so we should be able to attract some good tenants.

Looking at rental comps in the area, it looks like we can rent out the 3 bed/1 bath unit for around $2,500/mo and the bedrooms for $1,000/mo each. Let’s plug these numbers into our house hacking calculator and see if we can make this deal work (reply to this email and I’ll send you the link!).

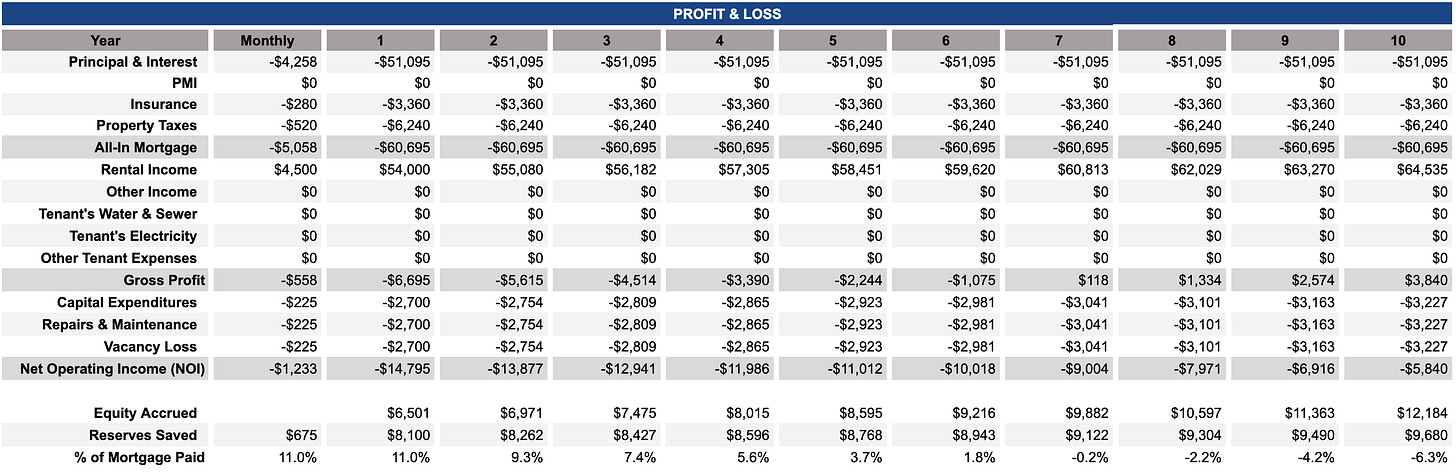

Our monthly outlay for mortgage + insurance + property tax comes out to $5,058 and we’re bringing in $4,500 in monthly rental income. Subtracting the two, we’re losing $558/mo in our first year living in the property ($6,696 for the whole year).

We’re also putting aside $8,100 ($675/mo) in the first year for capex, maintenance, and vacancy. Rolling that into our calculations, our year 1 out-of-pocket living cost comes out to $14,796. We accrue $6,501 in home equity in our first year, so the net living cost comes to $8,295 or $691/mo.

These numbers aren’t great given that we’re living with two roommates. As it stands, we’ll never break even on our property in the first 10 years (excluding equity buildup).

One strategy to boost net income would be to rent out the second unit as a short-term or medium-term rental, instead of a traditional long-term rental. Given Charlotte’s status as a regional hub, there’s a lot of business travelers coming in and out for work. If we’re looking for something that’s less of a day-to-day hassle, we could look into renting to travel nurses through a platform like Furnished Finder. Plugging our property into AirDNA, it looks like we can expect to earn roughly $2,900/mo on Airbnb. Is the active management worth the extra $400 per month? Probably not, and after fees, you end up around the same place. I’d forgo Airbnb and look into renting directly to travel nurses who are coming to the area on multi-month contracts. It requires less active management and you’ll likely come out ahead compared to renting on Airbnb.

Would I buy this property? Unlikely. It’s hard to see the upside here and in a market like Charlotte, renting seems far preferable to buying in the current market. The only way the numbers can pencil out is if you take a very hands-on approach to managing the property, but even then it’s questionable. It’s possible there are other strategies that could work (e.g. student housing), but I’m not very excited by the potential of this property.

Thanks for reading until the end - see you next week!