Happy Friday! Today, we're diving into the numbers on a fourplex investment in Boise, Idaho. Let's see if this could be a smart move for your portfolio!

Here’s the fourplex we’re looking at - it’s currently on the market for $1.05m and has four 2bd/1ba units.

This fourplex, built in 1993, is in the bustling Vistas neighborhood of Boise. It’s located close to Boise State University, making it an ideal spot for housing students, faculty, and staff. This means there will be steady demand for housing and potentially more attractive rental rates. We’ll assume we secure the property for the asking price of $1.05m. The interior of the property is dated, but livable - let’s assume we don’t put any money in for renovations right off the bat.

We’re going to make the following assumptions:

20% down with a 30-year fixed mortgage at 7% interest rate

0.51% annual property tax rate (based on Boise’s current rates)

$368/mo home insurance

5% reserve for vacancy

10% reserve for capex and repairs

2% annual rent and expense increase

We’re going to rent out three units and one bedroom in our unit. Based on rental comps in the area, it looks like we could get around $1,800/mo for each 2bd/1ba unit. For the single bedroom, we’re looking at around $900/mo. That brings our total monthly rent roll to $6,300/mo.

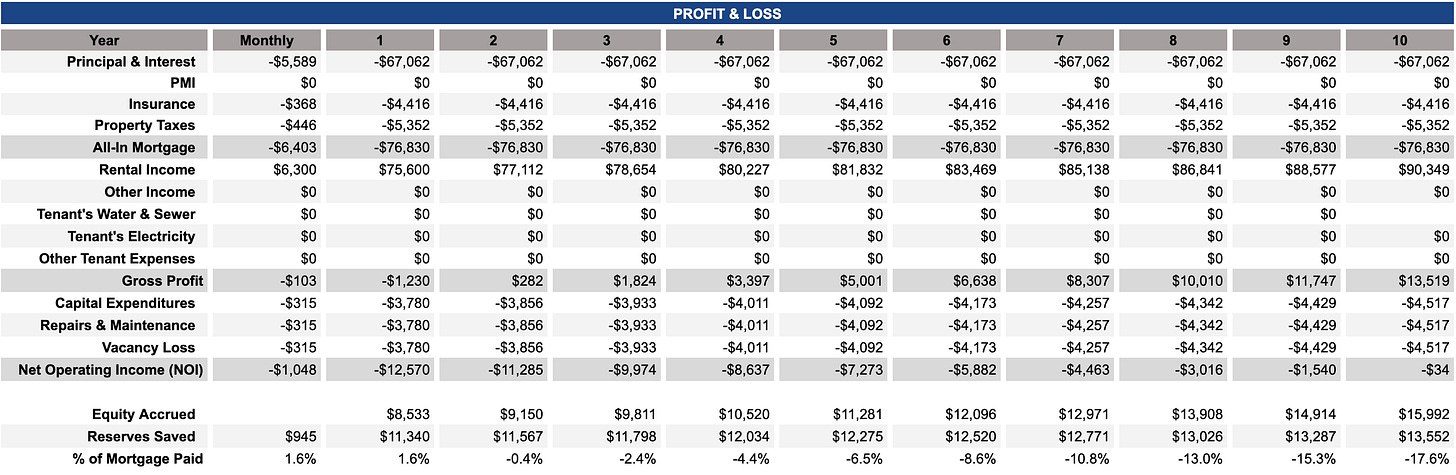

Plugging these numbers into our trusted house hacking calculator (reply to this email and I’ll send you the link!), we get the results below.

The initial results are solid! Our monthly outlay for mortgage + insurance + property tax comes out to $6,403, and our monthly rental income is only $6,300. That means we’re losing $103/mo before accounting for capex, maintenance, or vacancy. Obviously we don’t want to be losing money, but it’s a good starting point!

We’re setting aside $11,340 ($945/mo) in the first year for capex, maintenance, and vacancy. After taking this expense into account we lose $12,570 in our first year living in the property. We accrue $8,533 in equity, so our net loss comes out to $4,037 ($336/mo).

The current projections are better than I expected, but we’re still not making money on the property. Let’s think through whether we can juice the returns here. The first opportunity that comes to mind is providing furnished rentals for students + bundling utilities. If we spend, $2.5-3k furnishing each unit with bedroom, living room, and dining room furniture, we can probably boost rents $250-300/mo per unit. On top of that, if utilities average $200/mo, we can bundle them into the rent and charge $250/mo for it ($50/mo profit). If we charge $300/mo for furnishing and $250/mo for utilities, we’ll make an additional $350/mo per unit for little additional cost. We’ll leave the single bedroom out of this calculation for simplicity, but we could probably rent that out furnished as well. With the furnished units and bundled utilities, we’d make an additional $1,050/mo, more than covering the monthly loss that we projected above.

Would I purchase this property? If I was living in Boise, possibly. I’m a big fan of purchasing properties near universities and renting to students. I like the built-in rental demand, and I think there’s a lot of levers that you’re able to pull with student housing if you’re willing to scrappy.

Thanks for reading! Catch you in the next edition!